Search

RBI supersedes board of Srei Infra and Srei Equipment Finance

The Reserve Bank of India on October 4 superseded the Board of Directors of Srei Infra and Srei Equipment Finance Limited, owing to governance concerns and defaults by SREI Group Companies.

RBI supersedes board of Srei Infra and Srei Equipment Finance

The central bank of India has appointed Rajneesh Sharma, the former Chief General Manager at Bank of Baroda, as administrator.

Bounce back

Construction equipment finance has bounced back after the pandemic-forced lull.

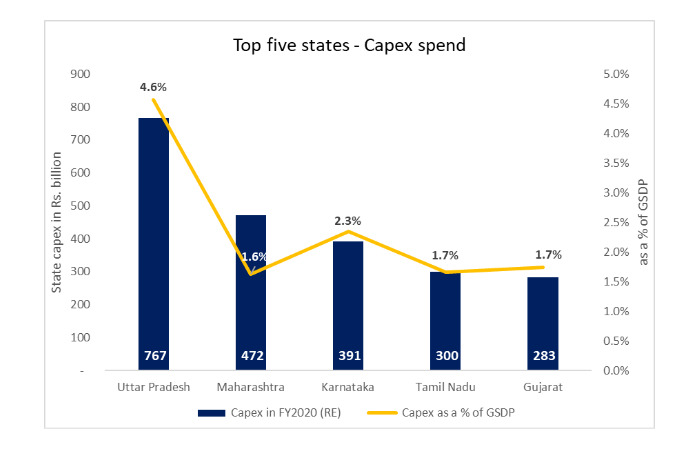

Budget cuts by states to adversely affect construction contractors: ICRA

The overall capex budgeted by states for FY2021 is likely to witness steep cut.

The World Has Changed

While at EXCON 2019, Union Minister Nitin Gadkari brought smiles to the faces of the worried construction equipment (CE) industry captains, the pandemic outbreak has wiped that smile into oblivion.

CRUSHING BARRIERS

Fragmented aggregate mining, as well as issues related to regulations and liquidity, are threatening the growth of the crushing and screening equipment segment in India.

Srei to continue its focus on equipment finance

Srei Infrastructure Finance and its wholly-owned subsidiary Srei Equipment Finance has consolidated the lending business of Srei Infrastructure Finance and Srei Equipment Finance into one entity since the focus for last four years has been on growing equipment financing and reducing the infrastructure loan portfolio.

All set to meet infra growth demand

Aggressive infrastructural development is imperative to the overall economic welfare of a country. If the economy is likened to a wheel, its infrastructure sector is most certainly the central hub that supports all the other sectors in the form of spokes and keeps the wheel spinning smoothly and efficiently.

Centre plans dedicated fund for infra finance

According to reports, the Union Government is planning to set up a dedicated fund of Rs 10,000 crore for financing infrastructure projects in the country. This will be a boost to the country?s infrastructure sector, requiring investments of more than $1.5 trillion in the coming ten years.

Centre plans dedicated fund for infra finance

The Union Government is planning to set up a dedicated fund of Rs 10,000 crore for financing infrastructure projects in the country. The fund ? through ?unconditional and irrevocable partial credit guarantee? ? will help enhance the credit rating of bonds issued by infrastructure firms so that they, in turn, can attract long-term investments especially from global insurance, pension and sovereign wealth funds.

Tata Motors Finance for used equipment finance

Tata Motors Finance is venturing into financing of used trucks and construction equipment.

Credit demand may pick up in the second half of FY 2015-16

In July 2014, the current government presented its first budget which was predominantly growth-oriented. The announcements made in the budget represented measures to tame inflation and provide a boost to investments in manufacturing and infrastructure sector.

8,500 km by March 2015: How Realistic is the Target?

The Union Finance Minister has set a target of 8,500 km of roads to be completed during the current fiscal year, which simply means construction of about 35.5 km of road per day! In the last couple of years,

RBI raises repo rate

The Reserve Bank of India (RBI) has raised interest rates to take on rising inflation, according to the RBI Governor Raghuram Rajan. RBI said that if retail inflation eases as projected, it does not foresee further near-term monetary policy tightening. The rate hike was driven by expectations of high but moderating consumer price index (CPI) inflation.

ECB proposal for funding local construction equipments

Agency reports suggest that some NBFC-AFCs (asset financing companies) want Reserve Bank of India (RBI) to allow External Commercial Borrowing (ECB) norms for funding domestically manufactured construction equipment. Recently, the central bank allowed NBFC-AFCs to avail ECBs for funding only imported equipments

Signs of revival, says ICEMA

As the Union government has recently taken policy initiatives and the Reserve Bank of India (RBI) has reduced interest rates, there are early signs of revival in the infrastructure sector, says the Indian Construction Equipment Manufacturers' Association (ICEMA).

The CE market is set to grow to over 100,000 units by 2016

The cumulative sales of backhoe loaders, crawler excavators and wheeled loaders have been growing at a CAGR of over 20 per cent for the last ten years and will continue to grow at an impressive rate.

Equipment makers see early revival of infra sector

As the Union government has recently taken policy initiative and the Reserve Bank of India (RBI) reduced interest rate, there are early signs of revival in the infrastructure sector, says the Indian Construction Equipment Manufacturers' Association.

RBI maintains policy rates

In its mid quarter monetary policy review, the Reserve Bank of India (RBI) kept key policy rates (repo and reverse repo) unchanged. Cash reserve ratio (CRR) or the portion of deposits banks keep with the RBI was also unchanged at 4.25 per cent. The central bank maintained its October guidance about policy easing in the fourth quarter given the recent inflation patterns and projections. Liquidity conditions will be managed with a view to supporting growth as stated in the second quarter review, t

Ajay Rawal new CMO of Magma Fincorp

Magma Fincorp announced the appoi?nt?ment of Ajay Rawal as Chief Marketing Officer (CMO). As CMO, he will anchor the Magma's branding ini?tiatives and guide the Channel & Product Development efforts.

Magma PAT up 82 per cent

Magma Fincorp, an asset finance company registered with the Reserve Bank of India, has announced strong numbers for the third quarter of the current financial year.

+91-22-24193000

+91-22-24193000 Subscriber@ASAPPinfoGlobal.com

Subscriber@ASAPPinfoGlobal.com